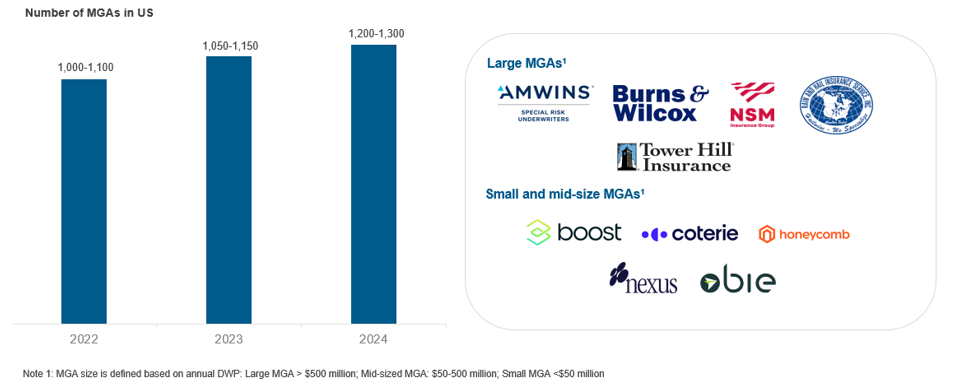

Managing General Agents (MGAs) are expanding rapidly as carriers’ delegate underwriting and distribution to agile, tech-forward partners. Their asset-light model lets them penetrate niche and hard-to-place risks, but it also creates distinct operational needs: large MGAs wrestle with data integration and real-time portfolio oversight, while small and mid-size players seek scalable infrastructure and carrier capacity.

Industry forces are converging to accelerate growth: cloud -based Process Automation System (PAS) and artificial intelligence (AI)-enabled analytics, intense Mergers & Acquisitions (M&A) and private equity interest, carriers’ demand for faster market entry, and rising regulatory scrutiny around privacy and capital adequacy.

Together, these dynamics are opening sizable white spaces for service providers that can deliver turnkey technology platforms, compliance tooling, integration support, and strategic consulting to help MGAs scale, remain profitable, and navigate a fast-evolving risk landscape.

Reach out to discuss this topic in depth.

MGAs are specialized intermediaries with delegated underwriting authority from insurers. They act as outsourced underwriting and distribution arms for carriers, sitting between insurers and retail brokers/agents.

MGAs can bind coverage and often handle policy administration and claims on behalf of insurers, typically focusing on niche or hard-to-place risks.

MGA geographic outlook:

The U.S. accounts for nearly 60% of the global MGA market, experiencing rapid growth, particularly in niche areas like excess and surplus lines, outpacing traditional Property & Casualty (P&C) and Life & Annuity (L&A) segments. The U.K. is the second-largest market, with MGAs offering a broad range of products, supported by innovation and insurer interest in delegated models. Major wholesalers and brokers in the U.K. are actively acquiring MGAs to expand capabilities.

While historically less receptive, the European market is gradually embracing MGAs due to increased technology adoption and demand for specialized expertise. In the APAC region, the MGA model is still emerging, with Australia leading, and markets like China and India presenting strong growth potential.

US MGA Direct Written Premium by Calendar year (US$ billions)

Operational insights: Unique challenges and strategies in large vs. small MGAs

MGAs encounter a variety of challenges that are intricately linked to the size and scale of their operations.

Large MGAs managing substantial premium volumes face significant challenges in scaling underwriting operations. Profitability may be strained by the pursuit of higher volumes, while operational complexity is heightened by the need to integrate data across diverse programs, IT systems, and acquisitions.

To manage operational complexity and maintain profitability, large MGAs implement robust audit protocols, utilize enterprise analytics for real-time portfolio oversight, and secure profit-sharing agreements with carriers. They also adopt advanced technologies and collaborate with service providers to uphold underwriting standards, while pursuing vertical integration such as forming risk-bearing entities to enhance control over capacity.

A case in point: Kaufman’s Burns & Wilcox, a large MGA, set up a Lloyd’s syndicate to participate in the risks it underwrites, thereby sharing in the underwriting results.

Small and mid-size MGAs face challenges in scaling efficiently due to limited infrastructure, lean staffing, and difficulty securing carrier relationships and capacity. Their lack of established track records and limited access to advanced data and actuarial support further hinder growth and operational resilience.

They partner with third-party providers for advanced technological capabilities in areas such as actuarial support, claims handling, and compliance, while adopting cost-effective cloud-based PAS. They also pursue strategic partnerships, M&A, and private equity investment to expand reach and improve efficiency without compromising niche expertise or service quality.

A case in point: Coterie enhanced its capabilities by partnering with ZestyAI for cloud-native, AI-driven underwriting andcollaborating with Five Sigma to integrate user-centric digital claims solutions.

While small and mid-size MGAs concentrate on establishing a firm market presence, refining their operations, and utilizing external support to optimize efficiency, large MGAs prioritize robust governance, advanced technology integration, and sustained profitability.

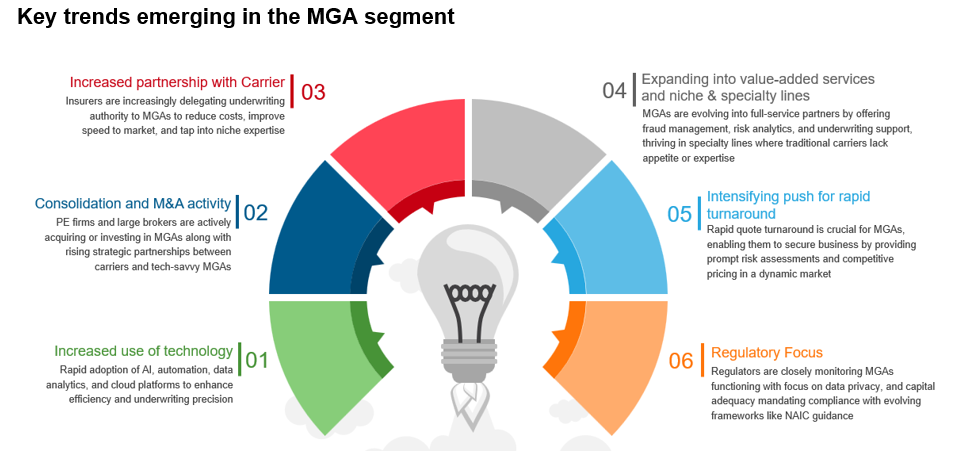

Key trends emerging in the MGA segment

The growth of MGAs is driven by insurer demand for specialized expertise, agility in niche markets, access to private capital, and technological advancements. Their innovative, cost-effective solutions, strong carrier partnerships, and focus on micro-niche lines with high retention and profitability make them increasingly attractive to investors.

Increased use of technology:

MGAs are at the forefront of innovation within the insurance industry with many emerging MGAs, are founded on a technology-first philosophy. They typically employ modern, cloud-based PAS, with platforms such as Guidewire (tailored for MGA use), Duck Creek, and proprietary solutions being widely used.

Given their emphasis on niche market segments, MGAs frequently utilize specialized data sets and risk models tailored to those specific areas. Furthermore, certain MGAs, especially those with claims adjusting authority have begun to adopt AI-driven fraud detection tools to enhance their operational capabilities.

As MGAs operate under an asset-light operations model, service providers can play a pivotal role by delivering turnkey technology solutions specifically designed to support their distinctive operational needs. These may include underwriting platforms, regulatory compliance tools, cloud-based PAS, and AI-enabled underwriting solutions.

Consolidation and M&A activities:

The MGA sector is undergoing significant investment and consolidation, especially in the U.S. and U.K., with both strategic acquirers (carriers, and brokers) and private equity firms targeting high-performing MGAs to expand in specialized markets. This heightened private equity interest is driven by the strong growth prospects and profitability potential that MGAs offer.

As M&A activity rises in the MGA sector, service providers have a key opportunity to support integration and scalability by consolidating systems, centralizing core functions, and developing unified operating models. There is also increasing demand for strategic consulting to guide post-acquisition realignment and ensure smooth transitions.

Increased demand from carriers:

Insurance carriers are increasingly collaborating with MGAs to accelerate market entry and streamline underwriting activities without building internal capabilities, reducing administrative overhead and fixed costs. Carriers also leverage MGAs’ established distribution networks and advanced digital platforms to enhance sales and distribution efficiency.

As MGAs assume broader responsibilities, the demand for comprehensive operational support spanning back-office services, IT infrastructure, and specialized talent is increasing, presenting a valuable opportunity for service providers to deliver impactful solutions.

Expanding into value-added services and niche & specialty lines:

MGAs are moving beyond the traditional underwriting activities with carriers delegating broader responsibilities including full policy administration, First Notification of Loss (FNOL) processing, and customer engagement.

They are also driving growth in specialty lines such as cyber, cannabis, Environmental & Social (E&S), and pet insurance, supported by their niche expertise, agility, and risk appetite.

MGAs’ ability to deliver tailored products through delegated authority, broker networks, and digital platforms is driving demand for advanced technology solutions. This creates opportunities for service providers to offer automation, AI, and compliance tools, along with scalable delivery models that support MGA growth and expansion.

Intensifying the push for rapid turnaround:

A faster quote turnaround is critical for MGAs to secure business from enterprises, as the highly competitive insurance market requires prompt risk assessments and pricing to capitalize on opportunities ahead of competitors. Enterprises have expressed higher satisfaction with MGAs that demonstrate quicker response times.

In response, MGAs are streamlining their operations by integrating automation, real-time data analytics, and AI-driven risk assessment tools to accelerate underwriting processes and generate rapid, accurate quotes.

Service providers can assist by delivering advanced technology solutions, such as turnkey automation platforms, cloud-based policy systems, and data integration tools that further refine these processes and support MGAs in maintaining their competitive edge.

Regulatory focus:

As MGAs take on expanded carrier responsibilities, they face increased regulatory scrutiny, especially around data privacy, financial resilience, and risk management. Compliance with frameworks like the California Consumer Privacy Act (CCPA), General Data Protection Regulation (GDPR), and Health Insurance Portability and Accountability Act (HIPAA) is essential, prompting greater investment in compliance, reporting, and risk oversight to meet evolving regulatory standards.

Final thoughts:

As MGAs scale and mature, they need reliable partners to deliver digital infrastructure, scalable operations, and compliance-ready solutions tailored to their agile, asset-light models. Additionally, ongoing M&A activity in the segment demands expert support for system integration, process harmonization, and operational transformation. Service providers that offer domain-aligned tech platforms, AI-driven tools, cloud-based PAS, and strategic consulting are well-positioned to become critical enablers of MGA growth, efficiency, and regulatory readiness in this high-growth segment of the insurance ecosystem.

To understand the role that service providers can play in this evolving ecosystem reach out to us to discuss how we can help you navigate the MGA landscape.

For more on MGA outsourcing trends and requirements, please contact Sahil Chaudhary ([email protected]) and Saket ([email protected]).